Why Subscribe to Sabeel Tech?

Ethical investments

Facilitate ethical investments by enabling automated Shariah compliance assessments and sustainability scoring, using AI-driven tools.

GeoAi

Expand investment opportunities into underserved regions, using GeoAI to assess potential projects in sectors such as agriculture.

Sustainability

Support Islamic Finance’s leadership in global ethical finance by promoting equity-based financing and sustainability.

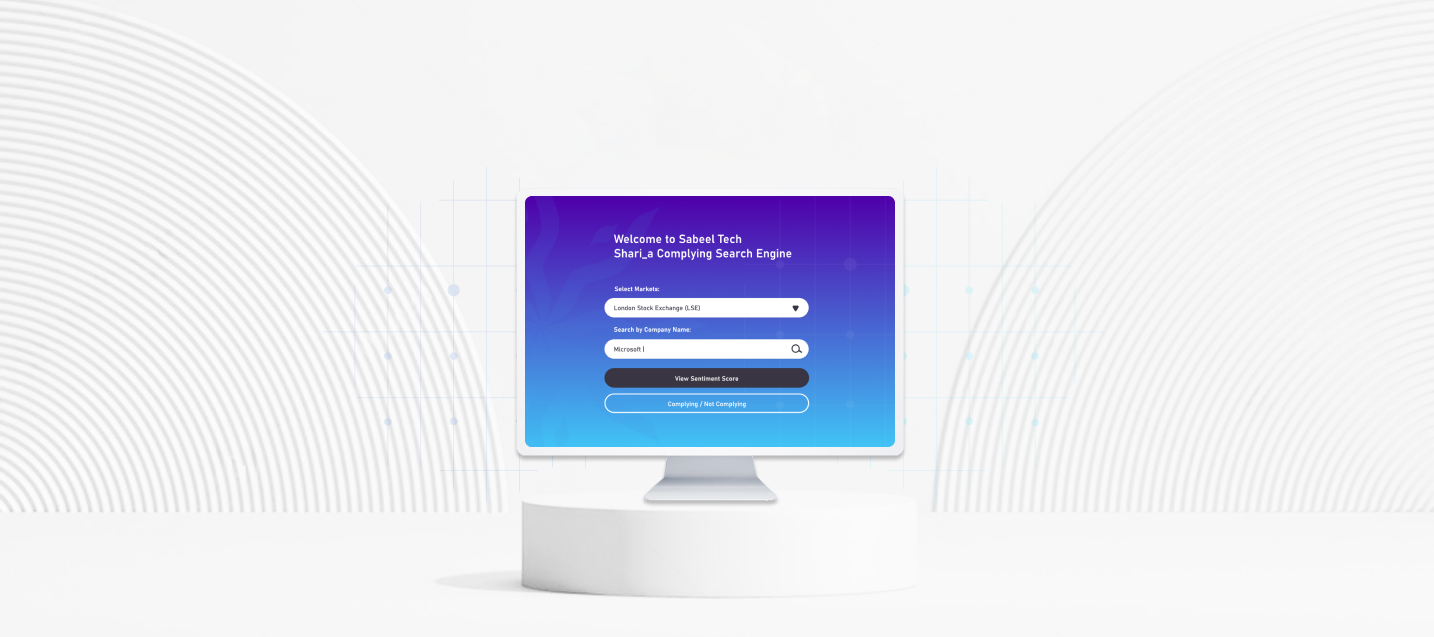

What innovative Platform does Sabeel Tech use for Shariah screening to ensure a company's compliance to Islamic values?

Automates the classification of companies and projects as compliant, non-compliant, or questionable, with a focus on equity-based financing (EBF).

AI-driven compliance and financial assessments ensure real-time monitoring and transparency in equity-based finance models.

Our Products

Shariah Standards Compliance and Equity Assessment Platform

The Shariah Standards Compliance and Equity Assessment Platform aims to address the challenges of debt-oriented Islamic finance by emphasizing profit-and-loss sharing and equity orientation.

Sustainability Automated Scoring and Reporting

The Sustainability Automated Scoring and Reporting tool provides a comprehensive assessment of companies and projects based on existing sustainability reports, utilizing the “Maqasid Shariah Sustainability Based Framework” and the Maqasid Shariah Ethical General Performance Score.

Geospatial Technology for Agri & Infrastructure Investments

Sabeel Tech’s Spatial Finance product integrates geospatial technology to identify and assess high-potential ethical investments, particularly in remote regions, thereby promoting sustainable development in agriculture and infrastructure.

Sabeel Tech provides tailored advice and support for financial institutions and investors seeking to integrate equity finance, sustainability, and Islamic ethical standards into their investment strategies.

Screening Process

Business Sector Screening

The business of a company will be conducted in accordance with Shariah principles as interpreted by the Shariah Advisor.

Financial Ratios Screening

Interest-Bearing Debt.

Interest-Earning Assets.

Income from Prohibited Activities.

Classification of Companies

Compliant Company.

Non Compliant Company.

Questionable (Requiring Purification).

Calculation Methodologies (For Listed Companies)

For companies with sufficient trading history.

For recent IPOs or companies without sufficient trading history.